A COVID-19 resilience test for B2B companies

COVID-19 has transformed the global business landscape.

So much so that in a matter of weeks after the onset of the pandemic in the United States, Congress provided more than $1.1 trillion in fiscal stimulus directly to businesses and distressed industries — four times more than was distributed during the 2008-09 financial crisis.

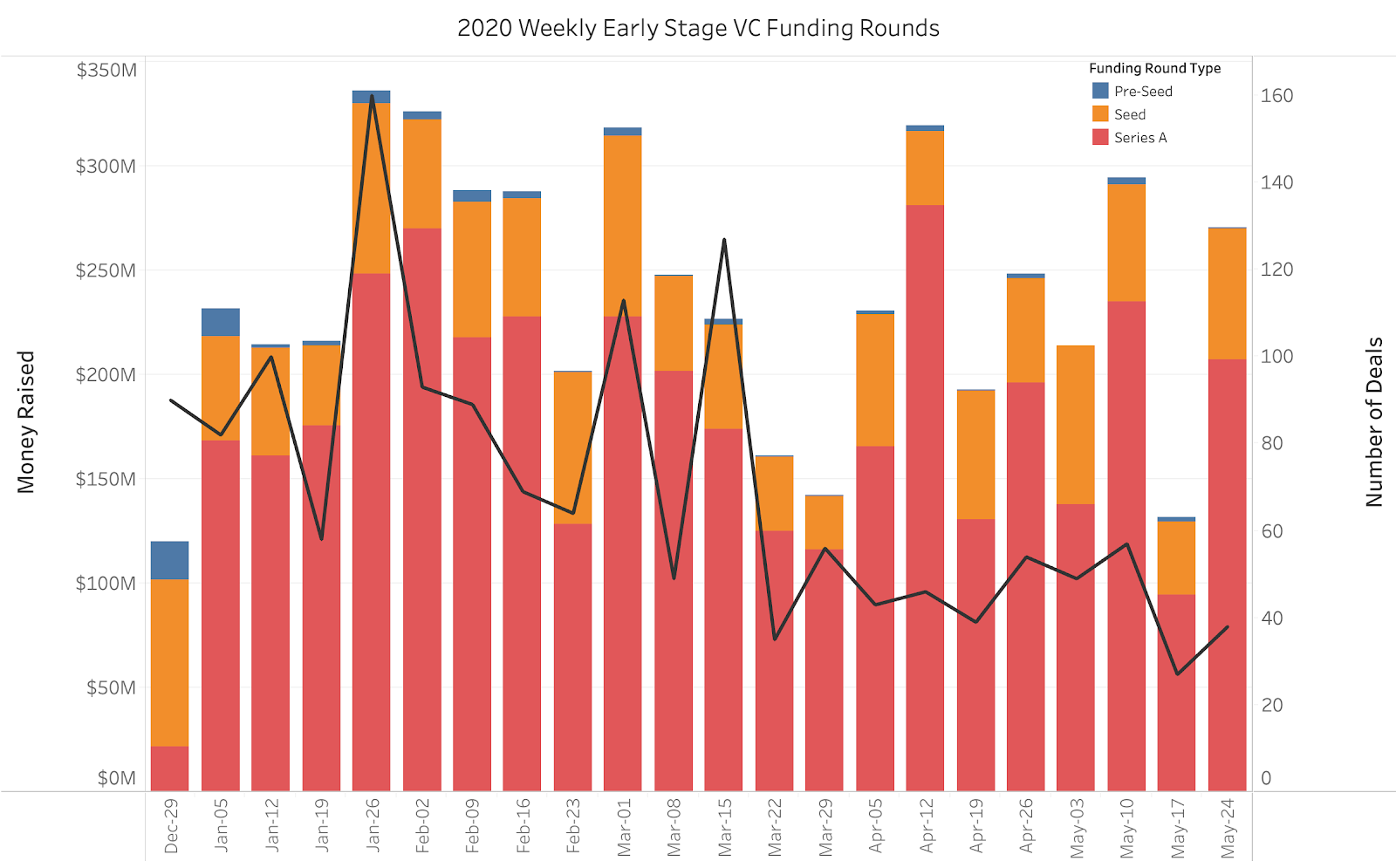

It came as no surprise when, at the start of COVID-19, venture capital investors largely went pencils-down for several weeks and shifted their focus to their existing portfolio companies. Extending company runways, preparing for longer funding cycles and managing operations in a novel business environment became the crux of company resilience. Now, moving into May, we can see this shift reflected in both the decline in number of early-stage companies funded and total capital invested.

As investors begin acclimating to this new normal, they have begun wading into new opportunities in time-proven, healthy industries and new emerging industries that are positioned to succeed during the pandemic. While we are seeing lower valuations, we believe certain B2B technology companies may be uniquely poised to thrive, and are pursuing investment opportunities in this space with a renewed focus.

Image Credits: Crunchbase Data via Tableau Public

*Excluding Biotech & Pharmaceuticals (Source: Crunchbase Data via Tableau Public)

Prior to COVID-19, early-stage B2B investors wanted to see strong growth and healthy unit economics; 3X year-over-year sales growth or 10% monthly growth was the gold standard. An LTV-to-CAC ratio over 3X signified a healthy payback cycle. There was less focus on capital efficiency; for every $1 million invested, investors were happy with $500,000 in generated revenues. Get to these numbers and your next funding round was guaranteed — but no longer.

During COVID, and likely beyond, company expectations and goalposts have been adjusted; 2X year-over-year growth may be the new 3X. While growth and unit economics are important, there are now new health indicators that will determine if a B2B company will thrive in a post-COVID world. With that in mind, we have put together a COVID reslience test that startups can use as a north star to grow their business in this new world.

This COVID-19 test is meant to be a gated checklist that will indicate where efforts should be focused, whether it be sales, product or finance. Before we leave you to your own devices, we wanted to walk through a couple of these new post-COVID questions that you should try to answer (and why they are relevant).

No comments: