15 things founders should know before accepting funding from a corporate VC

More than $50 billion of corporate venture capital (CVC) was deployed in 2018 and new data indicates that nearly half of all venture rounds will include a corporate investor. The CVC trend is heating up and the need for founders and startup executives to stay informed is higher than ever.

We’ve covered the basics in this series, including how to approach CVCs and what to know before the investment, what to look out for when negotiating, and getting the most out of a CVC partnership after the investment.

A great CVC investor can be the best of both worlds — a strong corporate champion who provides insights and connections to help your startup succeed and a committed financial partner who provides the capital you need to grow. But CVCs aren’t just VCs with different business cards. Finding the right CVC requires the right approach and strategy, and getting the right CVC on your cap table can bring unique and lasting value to your startup.

To wind down this series, here’s a list of the top 15 things every founder should know before signing a term sheet with a CVC.

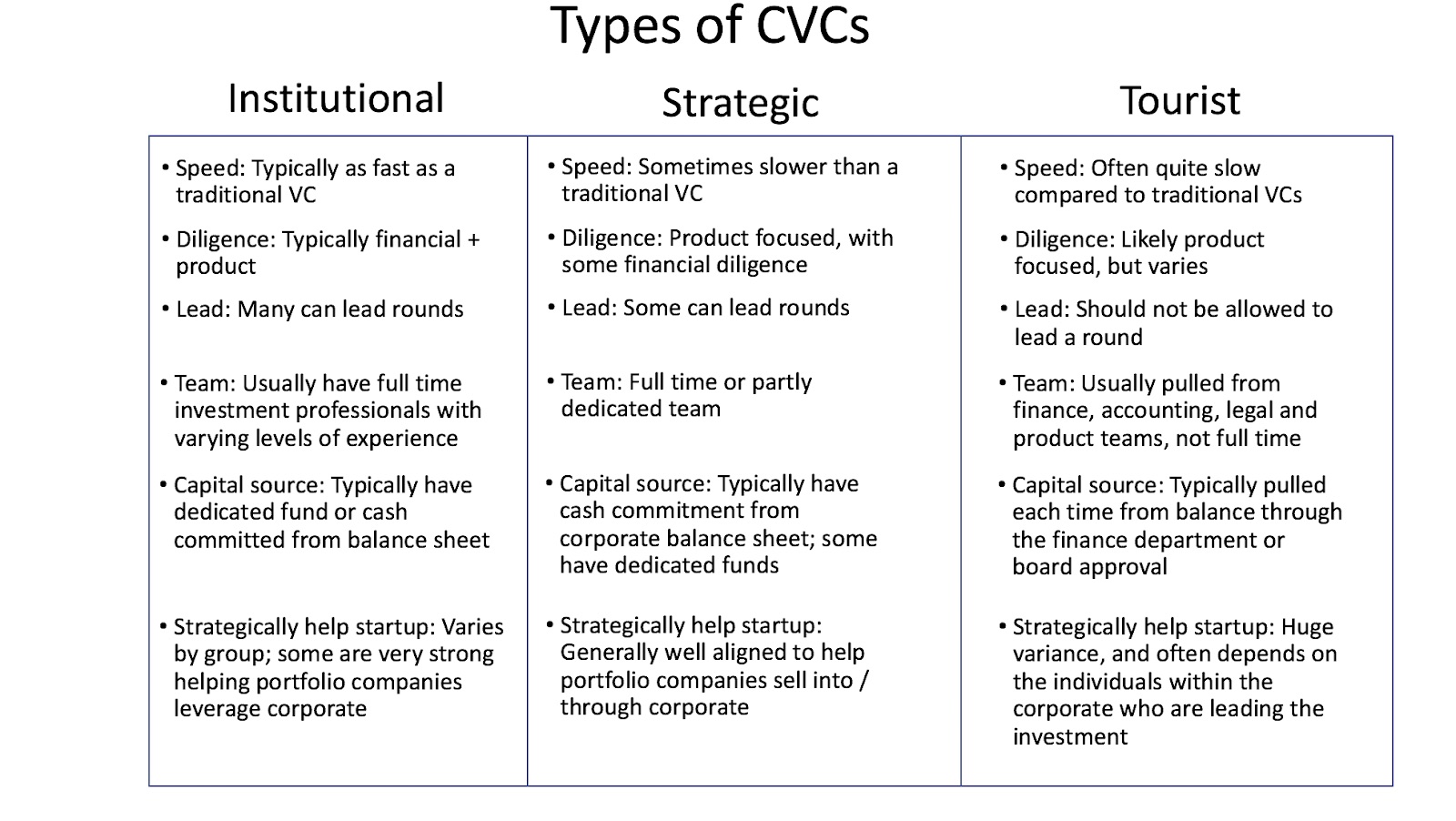

- CVCs come in three major types. The type of CVC you’re dealing with will determine a great deal about the potential for the partnership, the professionalism of the investing process, the resources you’ll have available once the investment is made and much more.

Image credits: Orn/Growney

- Different CVCs have different investing strategies. Some CVCs view deals through the lens of, “I’m looking for a great team, huge market and a chance to bring in funding and connections to make a business as strong as it can be.” Others see their investment like, “I’m looking for a solution/product/platform that I can bring into my company or use to expose my company to a brand new marketplace or technology.” As a founder, it’s best to know which type you’re dealing with before the pitch.

- CVCs can offer benefits beyond capital. Choose one who can offer money AND … . As Rick Prostko, Managing Partner at Comcast Ventures, says, “Look for someone who will understand your business, meet with you and decide that there’s something beyond just capital that will form the basis for that relationship. In today’s venture market, founders want money AND value. Seek out a CVC who has valuable experience to provide, and look for someone who’s been an operator in this segment previously or who has valuable insight and experience to offer.”

- Some CVCs are a better fit for your company than others. As with all investors, some will forge a better relationship with you and the exec team. But with strategic CVCs, the need for a strong bond at the outset is even higher since you’ll be embarking on a strategic partnership with the CVC’s parent company.

- Do your own diligence, just as they do theirs. The best way to find out what type of CVC you’re dealing with, what to expect in the investment process and whether your chances are strong for a post-investment partnership is to ask around. Talk to other companies within the CVC’s portfolio, or founders who’ve pitched the CVC in the past. Ask for their feedback on how it went and what to expect. You’ll never regret having more information.

- Come into the relationship with ideas for how the CVC can help your company. Do you see possibilities for product feedback loops? New distribution channels? A potential future acquisition by the parent company? Don’t be afraid to share your vision with the CVC during the pitch, and discuss how and whether that vision can be realized.

- Expect deeper product and technical diligence. CVCs have technical, product and market experts at their disposal, so their level of product diligence is typically more rigorous than traditional VCs. Be prepared for some grilling by subject matter experts. On the flip side, this diligence process provides you with exposure to potential customers and partners inside the corporation, so use this time to your advantage.

- Stay aware of what information you reveal during the diligence process. Remember that you’re sharing confidential info with a large company. If you stay thoughtful and strategic with what you share, and determine whether the CVC is truly interested in doing a deal before you offer financial, technical and competitive information, you’ll usually be fine. Don’t rely exclusively on NDAs — they only provide so much protection.

- Ask questions during negotiations. Do they want to lead your round? Do they want a board seat? Do they understand your future fundraising strategy? Will they be using experienced lawyers to do the deal? These are all important touch points during the negotiation process, and the answers will be revealing.

- . Set clear rules on ownership percentages ahead of time. As a rule, don’t let any single CVC own more than 19.9% of your company. If they own more than that, the CVC’s parent company will likely need to consolidate your financials into their annual and quarterly reports. If that happens, you’ll be required to get an expensive audit done, meet strict reporting deadlines and invest in financial planning and projections, all of which can hinder your bottom line.

- . Be sure to get the CVC to waive audit requirements. We mean it! Do everything you can to avoid any audit obligations. Audits are notoriously time consuming and expensive — we’ve seen audits by Big Four firms cost startups over $30,000. While many investor rights agreements “require” an audit, traditional VCs usually waive this requirement to avoid wasting a founder’s time and money. You want a CVC investor to do the same.

- . Never give a CVC a Right of First Refusal. Under no circumstances should you let a CVC get a ROFR, which would give the parent corporation the right to “beat” any other potential acquirer if and when you try to sell your startup. In practice, a ROFR means that no smart competitor to the parent organization will try to purchase your company because they know the CVC’s corporate arm will be able to swoop in and steal the deal.

- . Be aware that you run a risk of regime change. Staff turnover is a reality that CVCs face as much as any other large corporate operation. Ask the CVC leading your investment: Who will support the company if he or she leaves? What will happen to the CVC if the person leading the venture arm departs? Will the company still do their pro rata if personnel changes happen? What about commercial relationships that come from the relationship? You have a right to know as much as possible at the beginning, though the future can always change.

- . You may have to tackle regulatory issues. If the CVC’s parent company is in a certain area, it may be subject to government regulation. For instance, banks must adhere to a variety of regulations very different from those that apply to large tech companies. Navigating these laws can be costly and time consuming, so be aware of what you’re getting into before you sign the dotted line and discuss how you and the CVC can avoid hitting any regulatory roadblocks.

- . Know that you may face challenges in the relationship over time. While startups thrive on renouncing hierarchy, chasing innovation and pivoting on a dime, larger corporations operate at a different pace and under a different paradigm. Change comes slower, decisions often involve more parties and some business units have different priorities than others. As a founder, you’ll be in charge of navigating the CVC’s parent company in order to maximize the partnership value.

There are plenty of benefits to taking CVC investments. Many CVC investments lead to acquisitions, and even if the discussions with a CVC fall apart, your meeting can result in valuable introductions that yield new business relationships. The rising CVC trend offers a brave new world for entrepreneurs. If you know the ropes of CVC investing, you could be in for a partnership that benefits you both.

No comments: