First Dollar raises $5 million for a consumer-friendly healthcare savings account

In the startup world, the more confusing the sector is, the riper the opportunity to make a friendly user interface and rack in millions of dollars of venture capital. There’s Robinhood to make investing more transparent, Vested and Carta to make equity more transparent, and the list goes on. But when it comes to healthcare, a thorny, expensive and ever-changing sector, consumer-friendly options don’t quickly come to mind.

That’s why Jason Bornhorst and Colin Anawaty teamed up to launch First Dollar, a healthcare savings platform with a focus on HSAs (health savins accounts) that targets millennials and Gen Z.

First Dollar launched out of stealth today with a $5 million seed round, led by Next Coast Ventures with participation from Meridian Street Capital. Other investors include former athenahealth CEO Jonathan Bush, Everlywell CEO Julia Cheek, Bright Health CTO Brian Gambs and Capital Factory.

“There’s just enough healthcare-ness that makes it a little hard, that’s why you haven’t seen traditionally fintech companies go at it,” Bornhorst said, of the company’s focus.

First Dollar is launching on the thesis that it can help consumers get better use out of their healthcare savings accounts, or HSAs. HSAs are non-taxable savings accounts that can be used on medical expenses, doctor visit co-pays or medical prescriptions. Think of it as a 401(k), but for healthcare. Some employers offer HSAs as a benefit, and some consumers choose to open their own. First Dollar works with both.

“I would argue HSA is the worst marketed healthcare benefit in the USA,” said Bornhorst. “This benefit is wholly misunderstood and underutilized by most Americans.”

First Dollar works on both the front end and back end of HSAs. It charges employers a monthly administration fee to manage payroll contributions and HSA reporting.

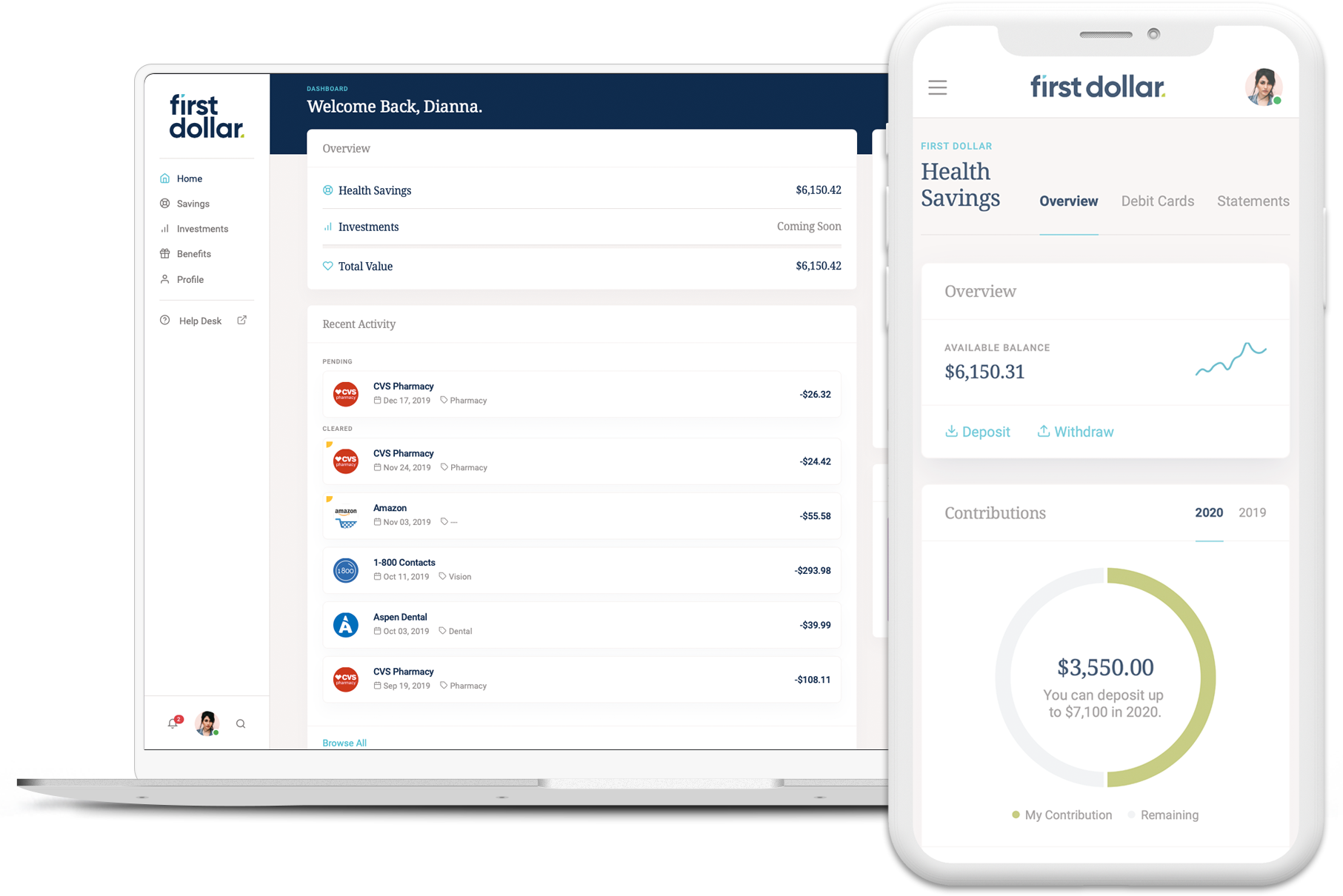

From an end-user perspective, First Dollar lets consumers set up a free account through their site and manage their money there. The company also issues a First Dollar debit card, and makes money from a percentage of transactions on the debit card. Using First Dollar, a customer can see where they can get the most savings on certain medical products. The startup is first focusing on drug discounts and has partnered with RxSaver, a national drug discount program.

Let’s talk through a customer experience to make this more clear. Users can transfer their existing HSA to First Dollar or create and fund a First Dollar HSA. The First Dollar account will show them discounted healthcare products and services. Then a user can receive the discount at a local pharmacy by showing the cashier a code from First Dollar.

First Dollar’s closest venture-backed competitor is Lively, which last raised $27 million back in October for its HSA product. The startup similarly targets millennials with low fees and online management, and focuses on getting users to treat HSAs as an investment account. Per Forbes, four other fintech startups also have HSA capabilities in beta testing.

Bornhorst said that First Dollar differentiates from Lively by focusing on educational content and creating a marketplace for customers to find healthcare products and services at lower price points. So while Lively would be more on the saving and investment side, First Dollar would be focusing more on the saving and spending side of things.

Additionally, the co-founders remain optimistic because of their track record: Before First Dollar, Bornhorst and Anawaty launched and sold a company to athenahealth, a massive healthcare company that works with millions of patients.

No comments: