Ex-YC partner Daniel Gross rethinks the accelerator

Amid skyrocketing operating expenses, remote work has become an obsession for Bay Area founders looking to have it both ways, accessing Silicon Valley’s networks of capital and opportunity without paying steep premiums for talent.

Daniel Gross has a deeper understanding than most of Silicon Valley’s opportunities. The Jerusalem native was one of Y Combinator’s early successes, joining with an AI startup that, at 23, he sold to Apple (we reported the deal was between $40-60 million). Gross served as a director of machine learning at Apple before returning to YC — this time as a partner.

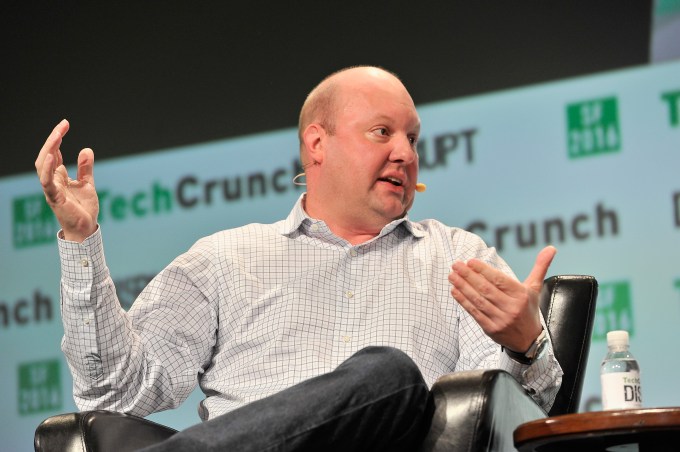

At age 28, his role at YC behind him, Gross is now working to revamp the startup accelerator model for a remote future with his startup Pioneer. He’s received backing from Marc Andreessen and Stripe to build a program he hopes can give founders access to funding streams and talent networks that are nearly impossible to find outside Silicon Valley.

“In the way software is eating the world, remote is almost eating earth in the sense that it may very well be the way large companies are created, but also perhaps the way that venture funding takes place,” Gross told TechCrunch in an interview. “With Pioneer, the product experiment we’re running is an attempt to build a San Francisco or Mountain View — to build a city on the internet.”

Marc Andreessen, one of Pioneer’s early investors.

That lofty goal has required quite a bit of tinkering on Gross’s part over the past 18 months since he launched the startup. During that time, he’s shifted the program’s structure from a Reddit-like online contest to win cash grants to what he calls a “fully remote startup generator” that can help remote founders create companies that later apply to Y Combinator or raise money from Pioneer.

“People were really taking advantage of Pioneer as kind of an online accelerator almost organically,” Gross says. “We decided to kind of operationalize that inside and focus more on funding people that are working on things that will turn into companies and potentially offer them more funding.”

Pioneer has already backed more than 100 founders, who have created solutions like remote team product There, desktop app generator ToDesktop and software search engine Metacode.

Pioneer is hoping their efforts can provide opportunities to founders in underserved geographies and regions, but like other investors in Silicon Valley, the startup hasn’t been backing nearly as many female founders as their male counterparts. From funded entrepreneurs publicly announced on Pioneer’s blog, less than 15 percent are women.

“Pioneer is an engine for finding, funding and mentoring underrated people, many of whom I suspect are female. Our minds are constantly spinning on ways to raise awareness amongst female founders and we’re working with our community to improve female representation,” Gross wrote in an email response. “The world could stand to have many more founders like Mathilde Collin (of Front) and Laura Behrens Wu (of Shippo), and we are eager to find them.”

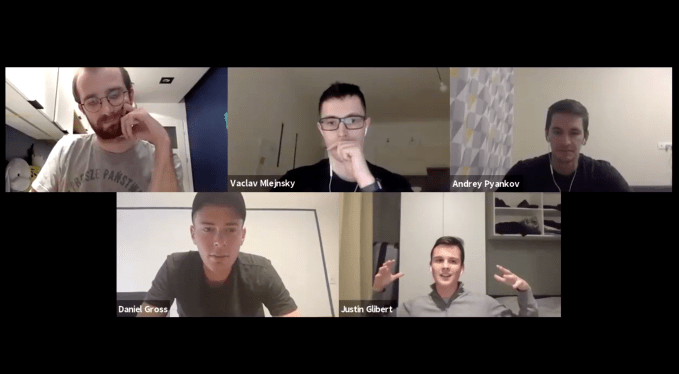

One of Pioneer’s livestream discussions during its remote program.

Pioneer’s existence is partially the result of an advent of remote work and communication tools, but another real enabler is the competitive market for early stage investing. Mega VC funds are competing over pre-seed deals for the buzziest startups and Y Combinator’s batch sizes are ballooning, leaving little room for accelerators with similar pitches. As the world of early stage startup investing gets more crowded, investors are having to get creative. For Gross and his investors, Pioneer also represents an opportunity to scout deal flow earlier in the pipeline.

Gross has a weighty portfolio of his own angel investments including GitHub, Figma, Uber, Gusto, Notion, Opendoor, Cruise Automation and Coinbase.

An earlier structure gave Pioneer the right to invest up to $100K in startups emerging from the program if they went onto raise, but just 30% of grant awardees went on to found companies, Gross tells me. In its 2.0 form, Pioneer wants participants to give up 1% of their company to join the one-month remote program. The accelerator won’t give them cash but will help founders incorporate their startups, give them guidance via a network of experts, and toss some other substantial perks like $100K worth of cloud credits and a roundtrip ticket to San Francisco to inject a bit of face-to-face time into the process.

The biggest evolution is the more formalized investment structure for founders exiting the program. If Pioneer is excited about the progress of a particular startup, they may give it the option to raise directly from Pioneer upon completion, sticking it in one of three investment buckets and investing between $20K and $1 million.

Gross acknowledges that Pioneer will largely be making bets closer to the $20K mark as the accelerator scales its portfolio. Pioneer is relying an undisclosed amount of early funding from Gross, Andreessen and Stripe for both its investments and operating expenses. Gross says that the company has additional funding sources lined up to facilitate some of these larger investments, but that he’s reticent to raise too much too early. “This being my second rodeo, I’m well aware of the downsides of over-capitalizing and so I think we’re going to remain nimble and frugal,” Gross says.

Gross isn’t looking to replace Y Combinator, and realizes that for founders with plenty of options, Pioneer’s investments might not be the most enticing. Y Combinator invest $150K in startups for a 7% slice of equity, by comparison, a $20K investment from Pioneer will cost founders 5% of their company plus the 1% they gave up to join the accelerator in the first place. Nevertheless, Gross hopes that plenty of founders sitting on great ideas will want to take advantage of this deal.

“I think there are a lot of great companies that instead of being listed on the S&P 500 are stuck at the phase where they’re just a Python script.”

No comments: