Lookout, Robinhood. E*Trade, Schwab, Ameritrade all go zero-fee

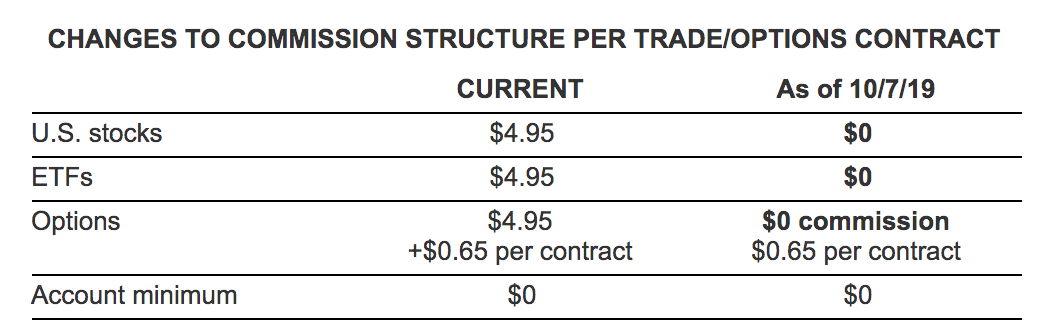

The biggest players in online stock trading all just copied Robinhood by removing their fees for stock and ETF trading. Charles Schwab announced yesterday it would drop its $4.95 fee, leading to plummeting share prices for it as well as competitors. By the end of yesterday Ameritrade announced it too would axe its $6.95 fees, and then E*Trade followed suit this morning killing off its own $6.95 fee. However, none of their share price recovered.

From yesterday before Schwab’s announcement through now, Schwab fell 12% from $41.84 to $36.54, E*Trade fell 19% from $43.69 to $35.20, and Ameritrade fell 28% from $46.70 to $33.54. Clearly investors aren’t thrilled that these financial giants are bowing to pressure from a measely startup.

Schwab drops its fees

Yet the move could definitely hurt growth for the $7.6 billion-valued fintech upstart Robinhood. It’s relied on the free stock trades to pull in users that it then monetizes with its Robinhood Gold subscription to premium services including the ability to trade on margin by temporarily borrowing money from the company.

“The changes taking place across the brokerage industry reflect a focus on the customer that‘s been inherent to Robinhood since the beginning” said a spokesperson for the startup. “We remain focused on offering intuitively designed products that reduce barriers to our financial system, including account minimums and commission fees.”

Robinhood was hoping a high 3% interest rate checking account feature announced in December might help differentiate it from online stock brokerages. But after it prematurely launched the checking product without proper insurance, massive backlash ensued and the company announced it would shelve and rethink the idea. But that hiccup didn’t stop it from raising another $323 million this July to bring its total raised to $862 million.

No comments: