Robinhood’s 3% interest checking & savings may not be properly insured

Robinhood’s new high-interest, zero-fee checking and savings feature seems to be too good to be true. Users’ money may not be fully protected. The CEO of the Securities Investor Protection Corporation, a non-profit membership corporation that insures stock brokerages, tells TechCrunch its insurance would not apply to checking and savings accounts the way Robinhood claims. “Robinhood would be buying securities for its account and sharing a portion of the proceeds with their customers, and that’s not what we cover” says SIPC CEO Stephen Harbeck. “I’ve never seen a single document on this. I haven’t been consulted on this.”

That info directly conflicts with comments from Robinhood’s comms team, which told me yesterday users would be protected because the SIPC insures brokerages and the checking/savings feature is offered via Robinhood’s brokerage that is a member of the SIPC.

If Robinhood checking and savings is indeed ineligible for insurance coverage from the SIPC, and since it doesn’t qualify for FDIC protection like a standard bank, users’ funds could be at risk. Robinhood co-CEO Baiju Bhatt told me that “Robinhood invests users’ checking and savings money into government-grade assets like US treasuries and we collect yield from those assets and pay that back to customers in the form of 3 percent interest.” But Harbeck tells me that means users would effectively be loaning Robinhood their money, and the SIPC doesn’t cover loans. If a market downturn caused the values of those securities to decline and Robinhood couldn’t cover the losses, the SIPC wouldn’t necessarily help users get their money back.

Robinhood’s team insisted yesterday that customers would not lose their money in the event that the treasuries it invests in decline, and that only what users gamble on the stock market would be unprotected as is standard. But now it appears that because Robinhood is misusing its brokerage classification to operate checking and savings accounts where it says users don’t have to invest in stocks and other securities, SIPC insurance wouldn’t apply. “I have an issue with some of the things on their website about whether these checking and savings accounts would be protected. I refered the issue to the SEC” Harbeck tells me. TechCrunch has reached out to the SEC and will update if we hear back about its perspective on the issue.

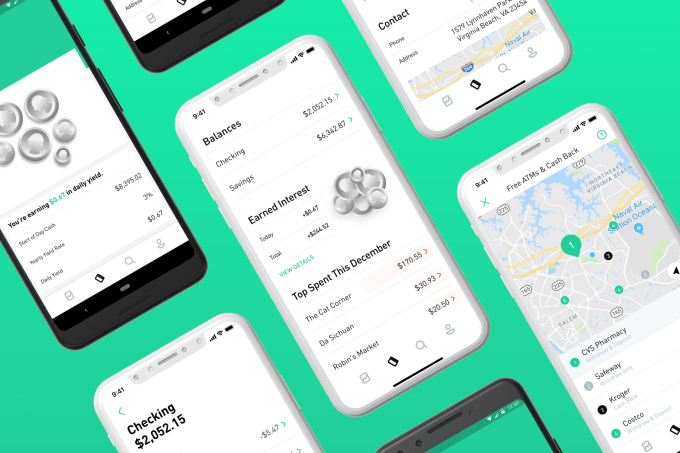

Robinhood planned to start shipping its Mastercard debit cards to customers on December 18th with users being added off the waitlist in January. That might need to be delayed due to the insurance problem. We’ve repeatedly asked Bhatt and Robinhood’s team for a formal statement and clarification this morning, but have not heard back.

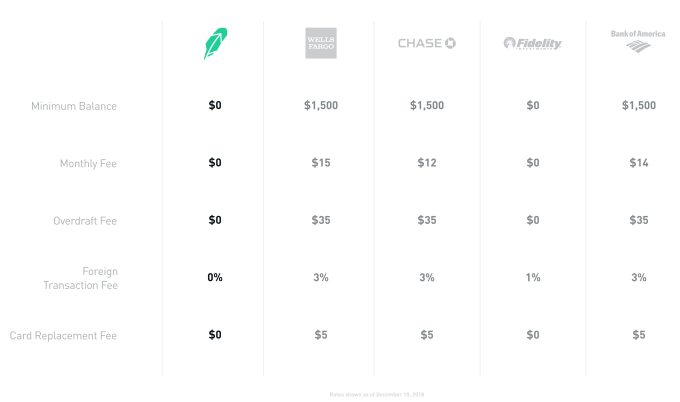

Robinhood touted how its checking and savings features have no minimum account balance, overdraft fees, foreign transaction fees, or card replacement fees. It also has 75,000 free-to-use ATMs in its network, which Bhatt claims is more than the top five US banks combined. And its 3 percent interest rate users earn is much higher than the 0.09% average interest rate for traditional savings, and beats most name brand banks outside of some credit unions.

But for those perks, users must sacrifice brick-and-mortar bank branches that can help them with troubles, and instead rely on a 24/7 live chat customer support feature from Robinhood. The debit card has Mastercard’s zero-liability protection against fraud, and Robinhood partners with Sutton Bank to issue the card. But it’s unclear how the checking and savings accounts would be protected against other types of attacks or scams.

Robinhood was likely hoping to build a larger user base on top of its existing 6 million accounts by leveraging software scalability to provide such competitive rates. It planned to be profitable from its margin on the interest from investing users’ money and a revenue sharing agreement with Mastercard on interchange fee charged to merchants when you swipe your card. But long-term, Robinhood may use checking and savings as a wedge into the larger financial services market from which it can launch more lucrative products like loans.

But that could fall apart if users are scared to move their checking and savings money to Robinhood. Startups can suddenly fold or make too risky of decisions while chasing growth. Robinhood’s valuation went from $1.3 billion last year to $5.6 billion when it raised $363 million this year. That puts intense pressure on the company to grow to justify that massive valuation. In its rush to break into banking, it may have cut corners on becoming properly insured.

[DIsclosure: The author of this article knows Robinhood co-founders Baiju Bhatt and Vlad Tenev from college 10 years ago]

No comments: